Freezing Act 46

These income tax cuts will benefit the wealthiest taxpayers more than any other group, and they are too expensive for the state to afford.

This proposal would change the income tax cuts made under Act 46 so they’re fairer and more sustainable. It would stop the tax brackets from moving each year and instead adjust them for inflation, while keeping the larger standard deduction that helps most families. These changes could save the state hundreds of millions of dollars every year—money that could help soften the impact of expected federal funding cuts.

Right now, Act 46 gives much bigger tax breaks to wealthy taxpayers than to everyone else. By 2031, the richest 1% will get average cuts of over $12,000 a year, while the lowest-income families will see only about $469. The law is expected to cost $240 million in 2025 and more than $1.4 billion a year by 2031, which would be about 12% of Hawaiʻi’s total tax revenue. Because income taxes make up about a third of the state’s budget, losing that much money could mean cuts to important programs and services.

At minimum, legislators should freeze the implementation of Act 46, which will keep the income brackets at their current amounts, while allowing the standard deductions to increase. This could save at least $296 million in Tax Year 2027—and it would also stop the cost from ballooning to $1.4 billion a year by 2032.

The proposal keeps one major benefit: a higher standard deduction that rises from $2,200 to $12,000 for single filers and from $4,400 to $24,000 for couples by 2031.

Adjusting the income tax cuts

We also recommend scaling back some of the tax cuts for high-income earners and raising taxes through other means.

Act 46 can be made more progressive by increasing the income tax rates for the top 5 brackets. For a single filer, this would affect people earning over $175,000.

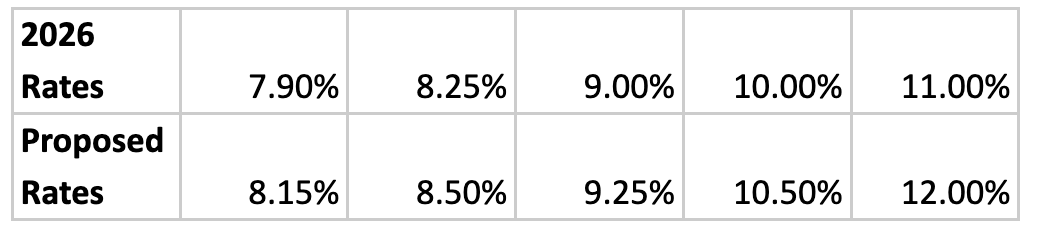

The $69 million estimate is based on the following tax rate increases:

By targeting the parts of Act 46 that give outsized benefits to the wealthy—while keeping the tax breaks for lower-income people—Hawai‘i can make Act 46 fairer and regain lost revenue.