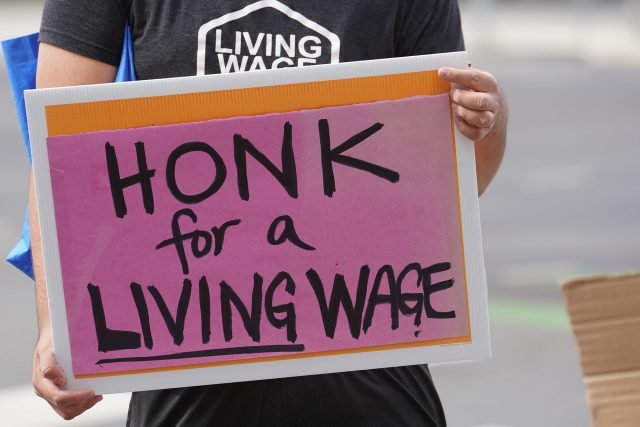

Hawaiʻi lawmakers finally agree on raising the minimum wage

House Bill 2510 also makes a state earned income tax credit refundable. Meanwhile, many taxpayers could soon get a $300 tax rebate.

House approves minimum wage, Mauna Kea bills after emotional floor debate

As the Legislature nears the halfway mark for this year’s session, measures to provide $600 million for Native Hawaiian housing and increase the capital gains tax also advance.

Hawaiʻi legislature 2022: smart spending could help big problems

Those ideas include increasing the very modest food and rent tax credits for low-income families, and creating a refundable state earned income tax credit that would put some additional money in the pockets of working families.

New taxes, tourism funding cuts among bills pushed through as legislature winds down

Lawmakers agreed on a number of measures Thursday that need full House and Senate approval and then Gov. David Ige’s signature.

Bill exempting jobless benefits from state taxes hits a snag

More than 580,000 Hawaiʻi workers filed unemployment claims last year, according to the governor’s office.

Hawaiʻi lawmakers again considering taxing income on REITs

Similar legislation was vetoed by Gov. David Ige in 2019, who warned that it would hurt investment in the islands.